How To Access Tax Returns

With an integrated management system that allows your to effectively record you income and expenses, PaTMa's is constructed with an built-in landlord tax return feature that is designed to be simple and user-friendly. Even without accountancy or bookkeeping experience, compiling the essential figure for your landlord tax return will be that much easier.

With the PaTMa landlord tax return feature, you don’t need to wait until the start of the tax year or the start of a tenancy. You can begin using it at any time of the year, and add new properties and new tenancies (and remove them) whenever you like.

The PaTMa landlord tax return feature allows you to upload documents alongside the records for every property in your portfolio. It avoids the need to file and store paper documents, searching for them when you need them and the risk of losing them.

Getting Started

- Navigate to Properties.

Note: This is located in the header as seen below.

You will be directed to a page listing your current properties. However, just underneath the header, you'll find a column with the titles Property List and Landlord List.

- In the column, click Tax Reports

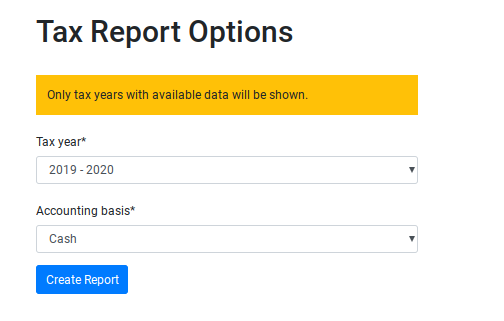

You will be directed to a page with the headline Tax Reports Options along with a form that must be filled, in order to access the information.

Filling In The Form

Tax year

It's important to remember that the tool only presents the tax years that have an available date.

Note: For example, if you opened a property for 2020, with no expenses or incomes relating to the year 2006, only the tax reports for 2020+ will be available, and not 2006.

Accounting Basis

You will be presented with two available options (ie. cash / GAAP).

Note: Depending on the information stored, the system will only work with the accounting basis most compatible with the recorded data.

- Once complete, select Create Report

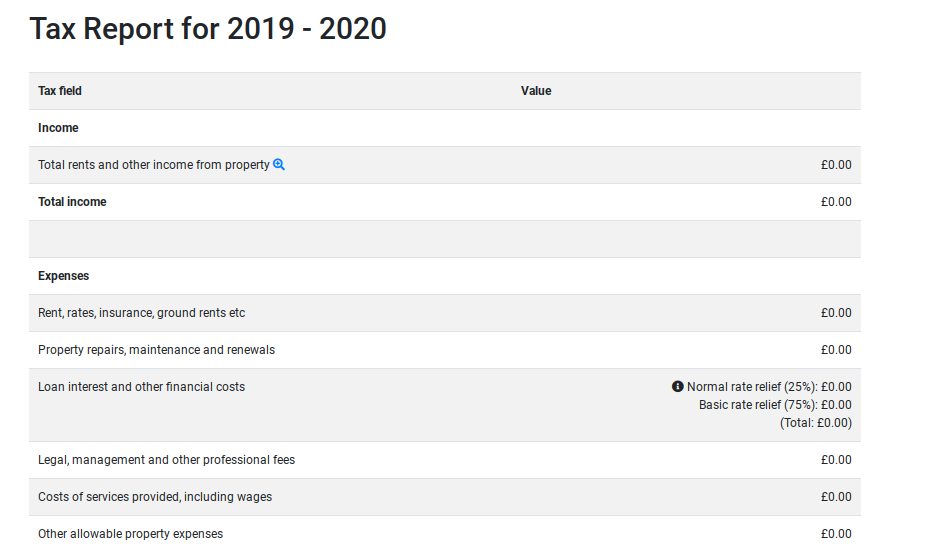

Understanding The Tax Report

According to the tax years and accounting basis selected, your tax report and tax returns will be presented below.

In the report, all your total expenses (Rent, Insurance, Maintenance, Legal Fees and Loans) will be deducted from the total income to calculate whether you have maintained a profit or a loss before tax is applied.

Note: In keeping with Section 24, a note will be presented stating this year's finance expenses, including interest, will only attract 20% tax relief, to portray how it is split and prepared for you to account for your tax returns

It's important to note that these tax return calculations are entirely dependant upon the data entered and it's accuracy. It's critical that you check the results yourself (use the per-item quick expansions to see the data behind each total). If at all unsure we always recommend that you seek professional advice.

As you scroll to the bottom, an estimated tax table that shows the amount of tax that is payable and your profit after tax that's been estimated under the different tax rate bands at section 24, portraying any changes that may occur over the transition as presented below.

Learn more about PaTMa Property Manager's features.